Updated thesis on Insurtech

Post latest news on Clinikk and emergence of new themes in insurtech, I am taking a re-look at the investment thesis on health insurance.

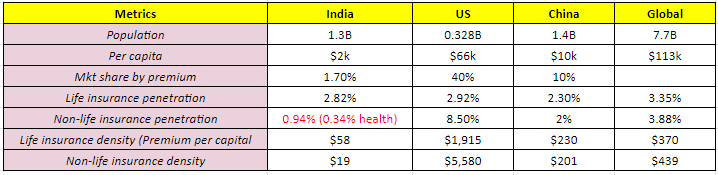

Country comparisons of insurance market

Note: Data from 2019-20

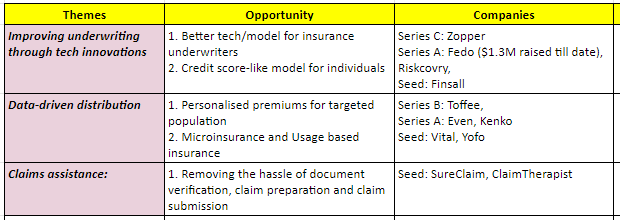

Opportunity Areas

Improving underwriting and claims assistance are insurance infrastructure plays in which which SaaS and IaaS players are emerging.

In this post, I will focus on consumer-facing distributors and the opportunity there:

Data-driven distribution

Thesis

The key takeaway is that health insurance industry inflection point stands at the hands of distribution more than underwriting.

Life insurance penetration increased from 2.7% in 2000 to 4.2% in 2020. This was largely driven by better distribution thanks to the ~10 lakh life insurance agents which bring 96% of new business premiums for underwriters.

Such agent activity is absent in health insurance because of lack of attractive commissions (Avg. Life insurance policy amount is 1.5Cr. vs 5-50 lakh for health insurance). For white collar workforce, ESIC already covers health insurance needs. For those who need health insurance, it becomes unaffordable.

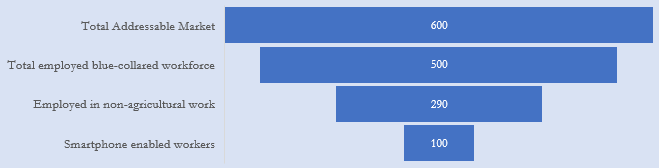

So, innovators enabling micro-insurance and usage-based insurance to increase the penetration of health insurance will help in unlocking the affordability and distribution for the ~600M Indians might have the right to win.

Market opportunity

Currently, most health insurance products in India are not made for this missing middle. They are exclusive, expensive and complex (with a lot of riders and waiting period). While PVHI is targeted towards high-income group, contributory products such as ESIS are not available for the general population. In 2020, IRDAI launched a standardized health insurance product called Aarogya Sanjeevani, mandated to be offered across all insurers. However, it has key challenges like high premium and long waiting period for inclusion of certain diseases (2-4 years).

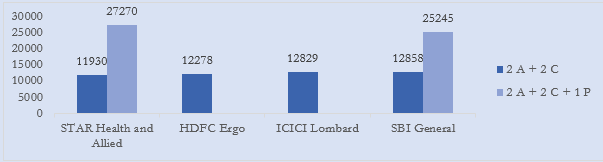

The avg. premium for hospitalization insurance is at least twice or thrice of what the missing middle can afford. The average annual premium is Rs. 12,000 for a family of 4 and Rs. 26,000 for a family of 5 with one dependent parent (Figure 2). Also, most of these products, including Aarogya Sanjeevani, do not cover OPD expenses.

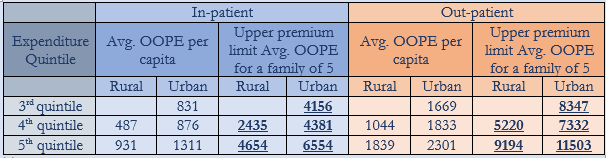

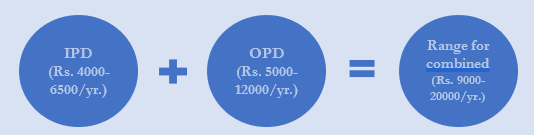

Most segments of the missing middle can afford to pay Rs.4000-6500 per family per year for hospitalization insurance and Rs. 5000-12000 for covering out-patient benefits (Table 2). It is also commercially viable as per one NHA statistic, the average premium per family can be Rs. 6,000 if <1 crore families (of 5) are enrolled for a sum insured of Rs. 5 lakhs. Combining the offering, the price range for a family can be Rs. 9,000-20,000, depending on services and income quintiles (Figure 3).

Given the equality of premium and the cost of sum insured means this can be effectively made a pre-paid subscription product.

Total Market Opportunity: 120M families * $200 (for a family of 5) = $24B

Total Addressable Market Opportunity = 25M families * USD 250 = $6.25B

Why I prefer GetVital over Clinikk (or which subscription model would I prefer)?

TLDR:

IRDAI compliance and license is a must, even for a distributor.

Focus on pure-play insurance. Instead of owning primary care and increasing redundancies, focus on building a vast network of hospital, healthcare professionals and services.

Now, details:

In the last post, I had prepared a thesis on Clinikk, now a series A stage which offers monthly subscription-based micro-insurance + owned primary care centres. However, one of the key risks laid out in the previous post has aged well today:

Lack of regulation: While companies partner with insurance providers and provide porting, currently provisions of consumer protection or solvency capital applied by IRDAI to insurance companies do not apply to them. Higher regulations on full-stack players, just like fin-tech industry, can make things complicated and hinder growth.

Recently, I have known through internal sources that there was a raid in Clinikk’s office, and the key contention was distribution of policies without an IRDAI provided license.

My take in this regard is:

Partnering with a licensed underwriter like Care Health does not solve the entire problem. You need to be IRDAI-registered to comply with all regulations.

It is better to be a pure-play player than being a full-stack owned managed care + insurance player. This avoids overlaps with your hospital network partners and reduce the redundant costs related to infrastructure or fraudulent OPD claims that you don’t have the capability to evaluate. Hence, a player with vast service network will have the right to win.

Therefore, I have shifted my focus from Clinikk to GetVital, which provides an online platform for health insurances. It features usage-based policies based on medical requirements. It offers medical credit line for paying health expenses. Also enables users to earn reward points for paying at hospitals, diagnostic labs, pharmacy, fitness & wellness centres, and more. IT also offers employer insurance for businesses.

Unit economics

Current subscriptions - ~50,000 families

MOM growth rate – ~10-20% (Assumed to be 10% for 2022/23 and 20% for 24E due to Pan India expansion)

MOM churn – 2-4% (Vital) to 7-8% (Kenko) (Assumed to be 3% due to high customer satisfaction)

Avg. Price of plan –

B2C - start from Rs. 500

B2B start from Rs. 200

Customer acquisition costs –

B2C - Rs. 6,000-Rs.8,000

B2B – Rs. 1,500

In the next posts, I will focus on 2 other interesting themes:

Improving underwriting through tech innovations

Hassle-free claims assistance